VBA code to generate an Excel workbook with dynamic pie charts for tracking paychecks

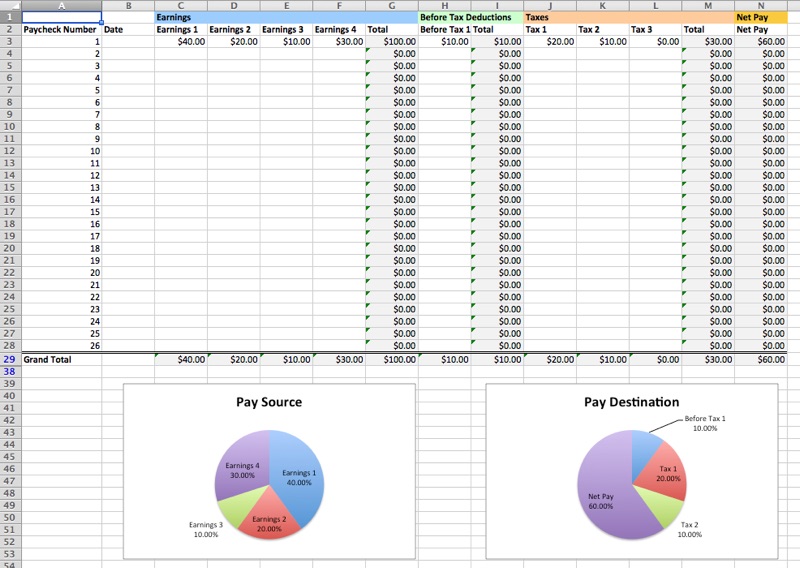

paychecks is a VBA module that generates a workbook for tracking an individual's paychecks. Specifically, the user specifies the number of initial rows for paycheck data and the number of columns (i.e., "buckets") for earnings, before tax deductions, after tax deductions, and taxes. Running main generates the workbook. The workbook can then be used like any regular Excel workbook, and the paychecks macro is no longer needed. Additionally, no macros are embedded in the generated workbook or are needed to use the generated workbook.

The generated paychecks workbook contains a number of features to facilitate tracking paychecks:

- The requested number of columns for each group (e.g., earnings, taxes, etc.)

- These represent the different "buckets" for pay source / pay destination

- Total column for each group

- Grand total row for each column

- Dynamic pie charts for "Pay Source" and "Pay Destination" that update in real-time to reflect the workbook's data and column titles

Hopefully this workbook will help the user track his or her paychecks and gain a better understanding of how the pies get sliced.

- Open the Visual Basic Editor in Excel and import / copy the code in

paychecks.bas - Edit the constants in

mainfor desired number of columns and rows - Run

main - The workbook should be created

- Rename generic column titles

- These are the labels used in the dynamic pie charts

- Save the workbook, add paycheck data, insert rows as necessary, and track paychecks.

paychecks has been successfully tested with Office 2013, Office 2011 for Mac, and Office 2016 for Mac.

Editing the constants as indicated in the code block below results in a workbook with 4 columns for earnings income, 1 column for before tax deductions, 3 columns for taxes, and 26 rows for paycheck data.

' column types and quantities

Const EARNINGS_COLUMNS As Integer = 4 ' 1 or greater

Const BEFORE_TAX_COLUMNS As Integer = 1 ' 0 or greater

Const AFTER_TAX_COLUMNS As Integer = 0 ' 0 or greater

Const TAX_COLUMNS As Integer = 3 ' 0 or greater

' initial number of paychecks / rows for paychecks

Const PAYCHECK_ROWS As Integer = 26A screenshot of the generated workbook: